“It is well enough that the people of the nation do not understand our banking and monetary system for, if they did, I believe there would be a revolution before tomorrow morning.” — Henry Ford

Admitting to my limited experience in understanding Economics 101, I was always mystified as to where the money went that was lost in the Market Crash of 2001. If money is a real commodity, MY loss might be YOUR gain--but it doesn't disappear. Someone made money--but who? I'm still mystified...

Admitting to my limited experience in understanding Economics 101, I was always mystified as to where the money went that was lost in the Market Crash of 2001. If money is a real commodity, MY loss might be YOUR gain--but it doesn't disappear. Someone made money--but who? I'm still mystified...Now we find that the Federal Reserve Bank has propped up the Markets following the "dips/dives" of the last two weeks. For background on the "money quote", you can read the link first. Or not.

Pushing On a String - The New York Fed

Edit: as an after thought to writing this post last night, I might add that I am reserving judgment as to success or failure since it's still early in the process. As I noted in the comments section, The Federal Reserve has evolved from hands off (eg. not doing anything about the 1929 to 1932 stock market collapse) to a Central Bank that has learned to take aggressive action, to the extent that it can, by providing money, or liquidity.

My point of concern here is that even for our times $55 bln in one week is a lot of coin -an annual rate of nearly $3 TRILLION. $55 bln a week makes the war in Iraq look like a petty cash expense. While I realize the Fed won't need to inject $55 bln every week into the system, I can't help but to wonder how much moolah it will take if the Fed has to address a market emergency that goes beyond the stock market and into the realm of something scary like the [10-15 times] leveraged OTC derivatives market.

Really the question that comes to mind - What is it that Bernanke and Paulson are afraid of to not allow the market to fall naturally? There's also the inflationary issue. While these open market operations involve money that is lent out for periods of 1 day to a few weeks, there is basic 'Money 101' velocity of money where each loaned dollar that is used ends up in someone else's pocket and so on. So even if the original loan is paid back each loaned dollar perhaps is spent on a futures transaction, then re-loaned by the seller of the futures contract, spindled, washed, rinsed, etc.

Effectively, billions are being created out of thin air by the NY Fed operations which end up being added into the money supply over time. It's no wonder they eliminated reporting M3. This sudden currency creation, in my simple mind, would seem to be dollar negative and bad from an inflationary standpoint for everyone over time.

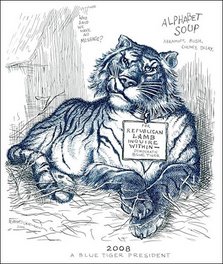

Oh, and with a 2008 presidential election cycle ahead, there also the question of what happens to Republican chances of capturing the White House again if the stock market goes into a bear market and the economy tanks into a recession. Perhaps that adds an extra dimension of urgency to keep the markets propped up? Now I'm getting too conspiracy theorist.

The specter of collapse and recession-cum-depression is coming clearer.

It seems to me that this "magician's trick" of conjuring money from thin-air is a very dangerous practice! Like a high-wire artist, one mistake can mean a deadly crash to the ground. Our economy, as Paul Krugman has been saying in various ways, is balanced on the razor sharp edge of collapse. Given the known cronyism and incompetence in the Bush administration, can we really trust that those in charge know what they're doing?

For some historical context and clarity on a few recent trends, I suggest a speech by Paul Krugman, NYT columnist and Professor of Economics, Princeton. Entitled A History of America's Disappearing Middle Class, it was delivered at the Economic Policy Institute's recent conference on The Agenda for Shared Prosperity.

Krugman is noted for his populist-based analysis of past, present and future economic issues. He has increasingly used a "political science" frame to express his views, believing that this is critical for his readers to understand the significance of events and policies that begin and end with GWBush.

How does the future look to you? Hopeful or hapless? Boom or bust?

(For more info to back up Krugman's references to unionism, see my Martian.Anthropologist posts Is Labor's "Day in the Sun" Over? Part One and Part Two.)

(Cross posted from God is for Suckers!)

No comments:

Post a Comment